Other information and FAQ

How and when do I pay tax contributions?

Upon starting your activity, URSSAF grants you a 90 days period to declare your income and pay dues for the first time.

You must declare your earnings even if they are zero. Payments must be made monthly or quarterly, depending on what frequency you chose in your application in chapter 2.

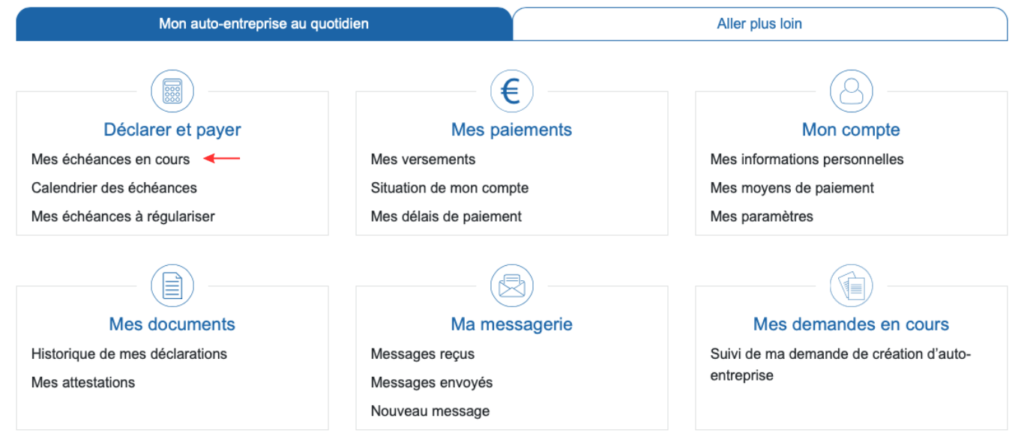

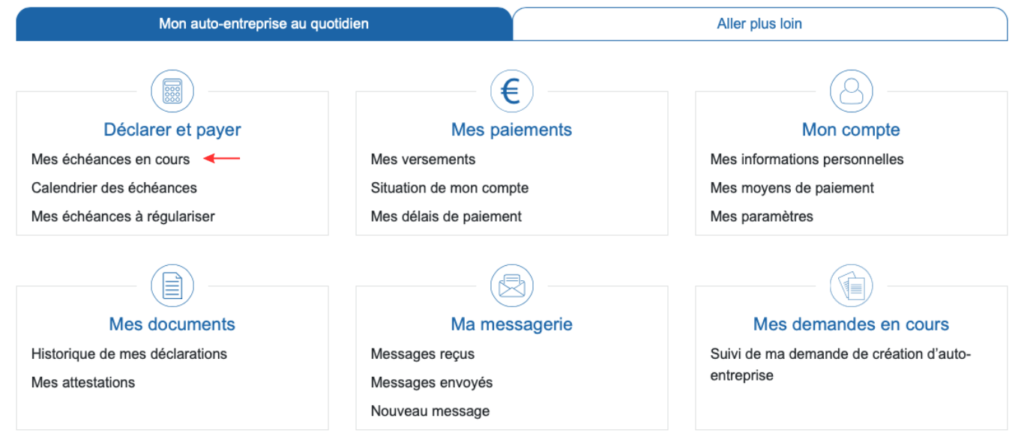

You can declare earnings and make payments by going to the URSSAF portal (then click on “Mes échéances en cours”) or downloading their app called AutoEntrepreneur Urssaf. If your ACRE request was approved (explained in chapter 3), you will see that your contribution percentages are halved.

Is there a ceiling to how much I can make?

Yes. The auto-entrepreneur status only allows you to earn up to a certain amount, varying depending on the nature of your work.

For example, if you are in a liberal profession (e.g., writer, translator, graphic designer, social media manager) and you invoice your client(s) for your services, your earnings cannot exceed €77,700 annually.

If you exceed the ceiling for your category, your status changes from “micro-entreprise” to “entreprise individuelle”. Learn more.

Do I need a social security number to set up a micro-entreprise?

No. Ameli experts have answered in official online forums that a social security number is not required during application. Additionally, if you look at the application steps outlined in chapters 2 and 3, at no point do any of the steps obligate you to provide a social security number.

It is URSSAF’s responsibility to forward your completed application to CPAM for your social security number to be created (and affiliated with the appropriate health insurance regime; this does not apply to working holiday makers, who are not eligible for public health insurance).

In other words, URSSAF will obtain a SSN on your behalf for administrative identification purposes, but you will not have access to social security benefits, including public health insurance.

Does TVA apply to micro-entrepreneurs?

TVA is the French acronym for value-added tax. Most businesses in France and the European Union must declare and pay TVA. However, according to article 293 B in the French tax code, micro-entrepreneurs can benefit from TVA exemption as long as they do not exceed certain earnings thresholds (see article 293 B).

If you meet the requirement, this means that your invoices to clients should not include a line for TVA. However, French tax code stipulates that the phrase “TVA non applicable, art. 293 B du CGI” must imperatively appear on all your invoices billed to clients. See the next chapter for an example.

How do I close my micro-entreprise?

If, for example, at the end of your working holiday you want to officially close your business, you must do so via the INPI Guichet unique portal. The steps are a bit more complicated for Working Holiday Visa holders, so we detail the exact steps in the next chapter.

Français

Français English

English

(11) Comments

Hi Jackson,

At the very end of the application process there is a series of documents that need to be uploaded. Two of which are:

Déposer le fichier :Certificate on the honor of non-conviction or absence of civil or administrative sanction likely to prohibit the exercise of a commercial activity, showing parentage *

Declaration on honor of non-conviction dated and signed in original by the person concerned *

I have read via a few platforms that you can simply write a template with the necessary information and submit this. I am confused though as it seems like both of these are very similar? Could you clarify what I need to submit for both of these documents.

Thank you for your help.

Hi Jackson, thanks for this info!

I already have a freelance business registered in my home country. Do I need to do all this if I only plan to continue working with my clients back home during my PVT, and not with new French clients? Can I mention my business as a means of supporting myself on my application?

Hi Oliver. This is a more complicated question that you should probably ask to a French tax/legal professional, because regardless of where your clients are you would be earning money on French soil, so it relates to tax residency. Sorry I’m not able to advise more!

Hi Jackson,

I am trying to follow your instructions to create an account with URSSAF, but I can’t because it keeps asking for my SIRET number (there is no box to tick to say that I don’t have one). Do you know if the rules changed.. and I need to have a SIRET number to create an account. Any help or advice you have on this, would be greatly appreciated. Thanks 🙂

Hi Alyssa. I think it’s possible that the process changed slightly, I will update the guide. If you are trying to create an URSSAF account to apply for ACRE, you can actually send your application via the messagerie even without an account at https://www.autoentrepreneur.urssaf.fr/portail/accueil/une-question/nous-contacter/courriel.html?choixacre=ok for social security number just use a placeholder number, and then explain your situation in the description. And then once you obtain a SSN, you can properly create a URSSAF account.

Actually Alyssa, I’ve just updated the guide. Hopefully you have what you need now.

Hi Jackson! Thanks for the help. I managed to apply for my status entrepreneur, but now I just need help applying for ACRE: how do I apply without receiving my social security number yet and without a carte d’identité francais (eg carte vitale, carte de sejour)? I only have 45 days to apply and it seems to take up to 6 weeks to receive these things!

Hey Marie-Rose. I don’t believe those things are needed to apply for ACRE. They’re not mentioned in the list of “situations”. I applied through the under 30 years old category and didn’t have to provide either of them.

Hello Jackson, thank you I have my SIRET number and I tried applying online through the link you sent but it requires a social security number to log in… is there something maybe I’m missing in the process?

When I also tried France connect, it required a French piece d’identite which I don’t have as well…So instead I sent them physical mail of my application, has anybody had success with this method of applying?

Hi Marie-Rose. I just updated the guide to reflect the fact that URSSAF requires SSN and SIRET now.

{{like.username}}

Loading...

Load more