Tax refund

As you pay tax on every payslip (every week), it is likely that you will pay too much tax, particularly if you only worked part of your WHV. In this case, you can reclaim part of the tax paid (tax refund) at the end of the tax year or when you leave New Zealand during the tax year.

Since 2019, the tax return has been automatic. Your contribution will be calculated automatically if the IRD has all the information relating to your income for the tax year running from 1 April to 31 March.

Between May and June, the IRD will automatically issue a tax assessment if your income comes from employment, investments (bank deposits or savings interest), or a benefit under an employee share ownership scheme. Your assessment will indicate whether you are entitled to a refund or whether you have to pay additional tax.

Check the information contained in the assessment and inform the IRD of any changes such as:

- any missing or incorrect information;

- any income of more than $200 (before tax) that you have received and that does not appear on your notice of assessment;

- changes to your contact details;

- changes to your bank details;

- expenses you can deduct from your income.

Estimating your taxes

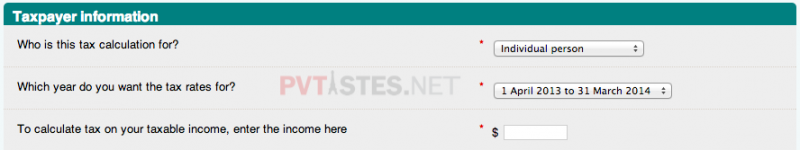

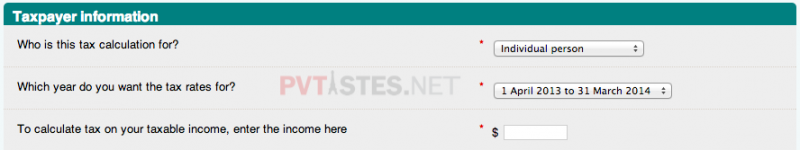

If, out of curiosity, you would like to know whether you have paid too much tax, use the calculator provided by the IRD: Tax on annual income calculator.

All you have to do is enter the gross amount of your income for the chosen tax year and the calculator will give you the amount of your tax deductions.

Without using the online calculator, you can simply multiply your income under $15,600 by 10.5% (then by 0.175 for income between $14,001 and $53,500 etc.) to find out the theoretical amount of your tax deductions.

If this amount is less than your total tax deductions (which is PAYE deductions less ACC) available in your online account, then you will receive a refund of the difference. ACC Earners Levy is not refundable.

Getting your tax refund

To obtain your tax refund, you simply need to wait for your tax assessment. If, after checking, your information appears to be correct and you do not notify the IRD of any changes, you will receive the payment into your account within a week.

Special rules for tax refunds for the current tax year

If you are leaving New Zealand permanently and want to request a tax return for the current tax year, you must submit form IR3 for the current tax year. You can complete this return directly on your MyIR profile or at an IRD office.

It takes a little longer to receive your tax return if you apply during the tax year. Allow around 10 weeks.

You can find contact details for all IRD offices in the country on this page.

Alternatively, if you’re not in a hurry, you can simply wait until the end of the following tax year to receive the automatic assessment. You will receive your tax refund in your New Zealand account. We therefore recommend that you leave it open. You can then transfer the money received from the IRD to your account in your country of origin. Don’t hesitate to meet your bank advisor before leaving New Zealand to discuss how to close your account from abroad.

Finally, if you want to transfer your money from your New Zealand account to your account in your country of origin when you return, the international money transfer specialist Wise offers those who have never used their service a first transfer free of charge via pvtistes.net.

Français

Français English

English

0 comments

{{like.username}}

Loading...

Load more