[Optional] Applying for the ACRE exemption

Once you’ve submitted everything for the creation of your business, you should then inform yourself on the ACRE exemption. You don’t need to wait for your SIRET and social security numbers before starting this. ACRE is not a mandatory step, but is very financially advantageous.

What is the ACRE exemption?

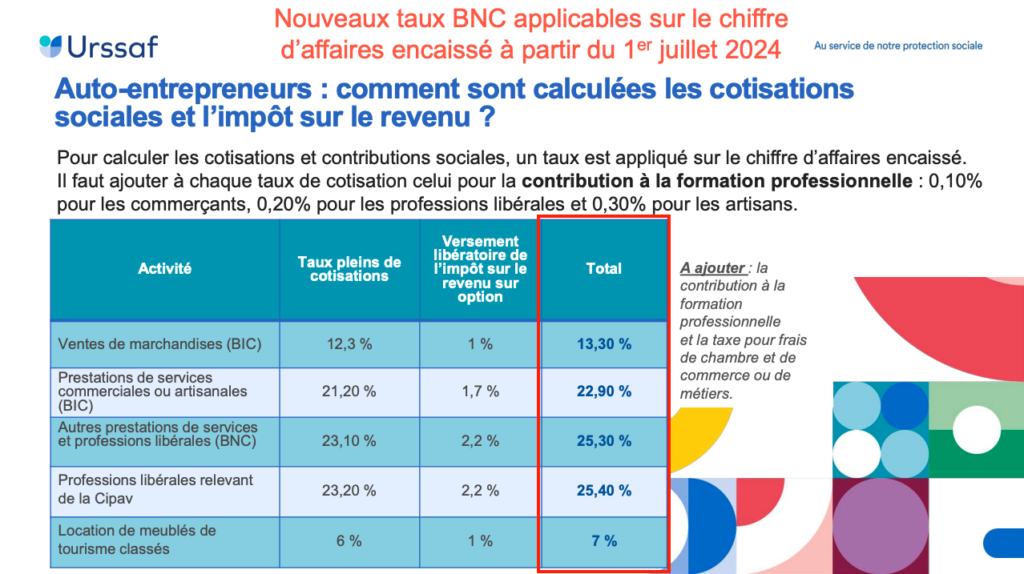

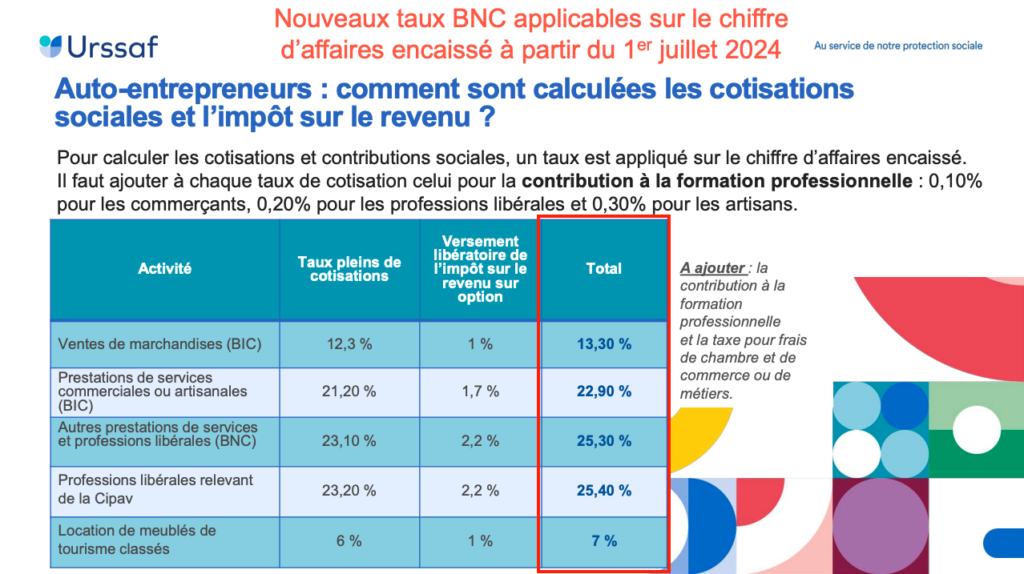

Like anywhere else in the world, freelancers and small business owners in France have to pay a percentage of their earnings as social contributions to the state. The percentage varies depending on the nature of your business. Here are the latest full figures from URSSAF, effective as of 1 July 2024.

The ACRE exemption (aide aux créateurs et repreneurs d’entreprise) is a benefit for qualifying first time entrepreneurs that cuts these contribution percentages by HALF for the first nine months of operation. It is the administration’s way of supporting new and young business owners, so it can help you keep a lot more money in your pocket. Starting on the tenth month, full rates automatically apply.

Eligibility

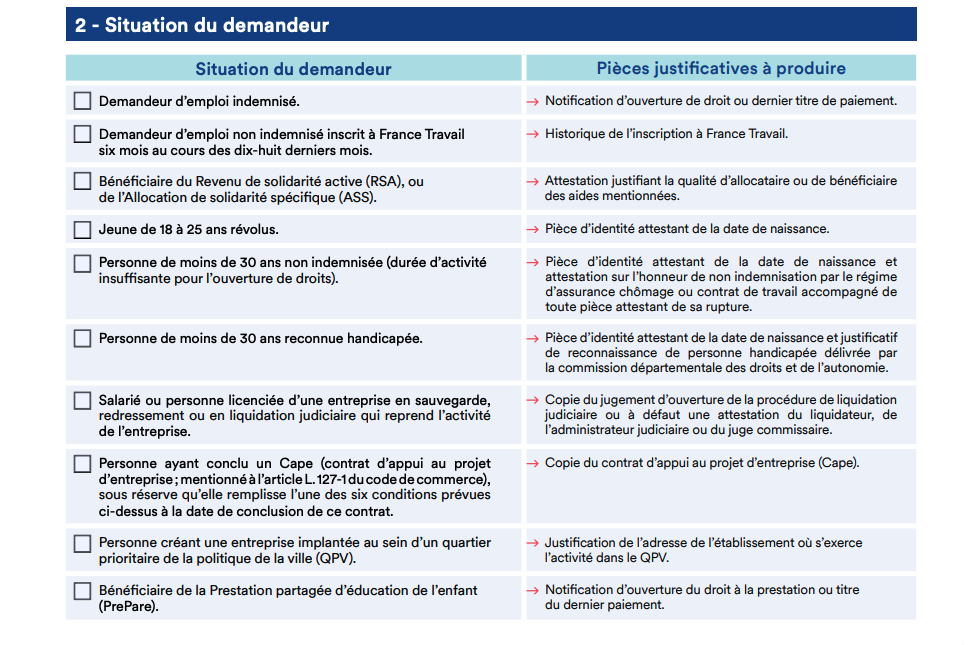

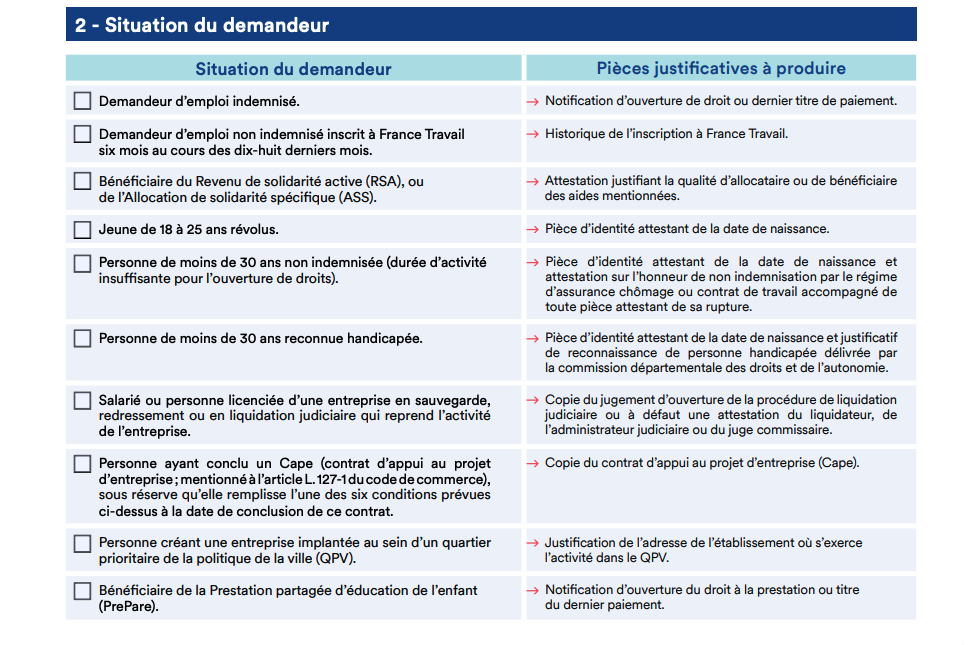

Applicants (including WHV and APS holders) just need to meet one of the following criteria; the first column is the situation and the second column lists the corresponding supporting documents required.

Many of the situations are not applicable to most WHV holders. The most relevant ones are:

- Between 18 and 25 years old, inclusive.

- Persons less than 30 years old not benefiting from unemployment insurance payments.

If even one of the above situations applies to you, then you are eligible to apply for ACRE.

How and when do I apply?

This request should be submitted immediately following the steps outlined in chapter 2. If you meet the criteria, complete the ACRE application form.

Also prepare the following supporting documents:

- The justificatif de création d’activité that you received after completing the steps in the previous chapter.

- Your passport, visa, and signed letter attesting that these pieces of identity indeed belong to you.

- Any other documents outlined in the “situations” table above.

Send everything via the messaging service on URSSAF. You do not require a URSSAF account in order to send a message here.

If you’re still waiting for your SSN to be assigned, for that field you can enter a placeholder number and explain your situation in the text field below. In your request be sure to include a clear identifier, such as the number from your justificatif de création d’activité.

According to URSSAF, a decision will be made within 30 days. If your request is denied, you will be notified. If your request is approved, you may or may not be expressly notified. URSSAF states that the absence of a response within 30 days can be interpreted as an acceptance of your request. You can also confirm whether your request was approved when you pay your contributions for the first time (explained in chapter 5).

Français

Français English

English

(11) Comments

Hi Jackson,

At the very end of the application process there is a series of documents that need to be uploaded. Two of which are:

Déposer le fichier :Certificate on the honor of non-conviction or absence of civil or administrative sanction likely to prohibit the exercise of a commercial activity, showing parentage *

Declaration on honor of non-conviction dated and signed in original by the person concerned *

I have read via a few platforms that you can simply write a template with the necessary information and submit this. I am confused though as it seems like both of these are very similar? Could you clarify what I need to submit for both of these documents.

Thank you for your help.

Hi Jackson, thanks for this info!

I already have a freelance business registered in my home country. Do I need to do all this if I only plan to continue working with my clients back home during my PVT, and not with new French clients? Can I mention my business as a means of supporting myself on my application?

Hi Oliver. This is a more complicated question that you should probably ask to a French tax/legal professional, because regardless of where your clients are you would be earning money on French soil, so it relates to tax residency. Sorry I’m not able to advise more!

Hi Jackson,

I am trying to follow your instructions to create an account with URSSAF, but I can’t because it keeps asking for my SIRET number (there is no box to tick to say that I don’t have one). Do you know if the rules changed.. and I need to have a SIRET number to create an account. Any help or advice you have on this, would be greatly appreciated. Thanks 🙂

Hi Alyssa. I think it’s possible that the process changed slightly, I will update the guide. If you are trying to create an URSSAF account to apply for ACRE, you can actually send your application via the messagerie even without an account at https://www.autoentrepreneur.urssaf.fr/portail/accueil/une-question/nous-contacter/courriel.html?choixacre=ok for social security number just use a placeholder number, and then explain your situation in the description. And then once you obtain a SSN, you can properly create a URSSAF account.

Actually Alyssa, I’ve just updated the guide. Hopefully you have what you need now.

Hi Jackson! Thanks for the help. I managed to apply for my status entrepreneur, but now I just need help applying for ACRE: how do I apply without receiving my social security number yet and without a carte d’identité francais (eg carte vitale, carte de sejour)? I only have 45 days to apply and it seems to take up to 6 weeks to receive these things!

Hey Marie-Rose. I don’t believe those things are needed to apply for ACRE. They’re not mentioned in the list of “situations”. I applied through the under 30 years old category and didn’t have to provide either of them.

Hello Jackson, thank you I have my SIRET number and I tried applying online through the link you sent but it requires a social security number to log in… is there something maybe I’m missing in the process?

When I also tried France connect, it required a French piece d’identite which I don’t have as well…So instead I sent them physical mail of my application, has anybody had success with this method of applying?

Hi Marie-Rose. I just updated the guide to reflect the fact that URSSAF requires SSN and SIRET now.

{{like.username}}

Loading...

Load more