Completing the Tax Code Declaration IR330

When you start a new job, your employer will provide you with form IR330, normally at the same time as your contract of employment. You must complete it and return it to them before you start work.

The form is also available here.

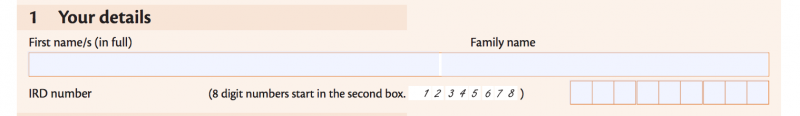

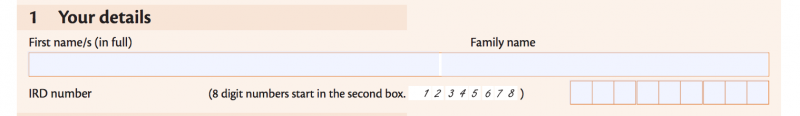

1. Your details

In the first section, “Your details”, simply enter your first name, last name and 9-digit IRD number.

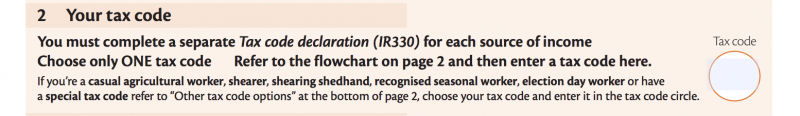

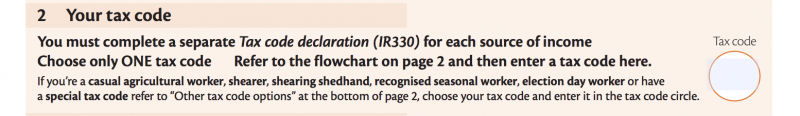

2. Your tax code

In the second section, “Your tax code”, you must enter the tax code, made up of one to four letters, corresponding to your job. To find out, follow the instructions on page 2 of the online form. If you do not complete this box, you will be taxed at 45%.

- If this is your main job, in most cases, the code will be M. For a secondary job, and if you have already declared a main job, you cannot use code M again. Choose code SB, S or SH depending on the amount of your income.

- Seasonal jobs in horticulture often refer to “Other tax code options”. For example, if you are a seasonal agricultural worker employed on a day-to-day basis for a period of less than three months, you fall under the CAE code (as “Casual Agricultural Workers”).

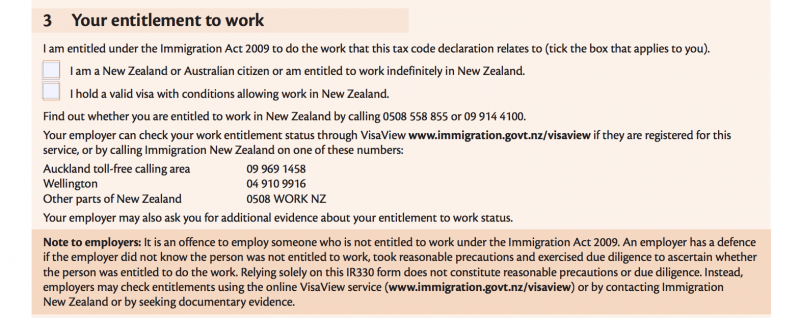

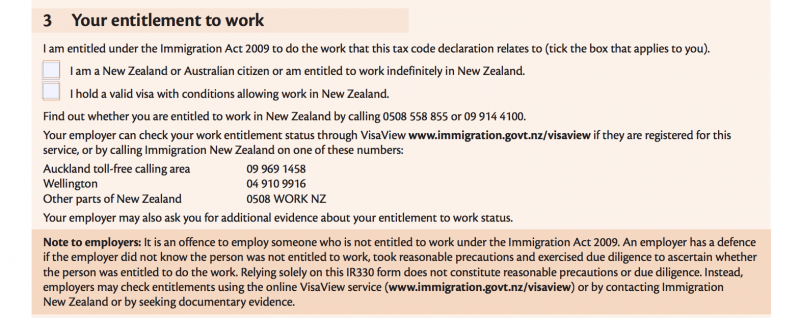

3. Your entitlement to work

In the third section, “Your entitlement to work”, tick the second box: “I hold a valid visa with conditions allowing work in New Zealand”.

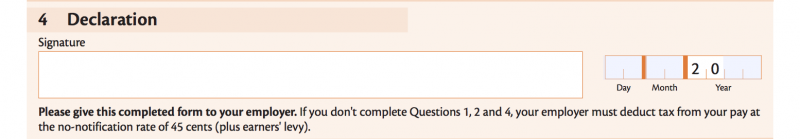

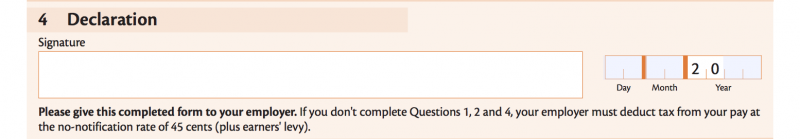

4. Declaration

Lastly, in the “Declaration” section, sign and date your declaration.

To check your tax rate and the amount deducted in relation to your tax code and the amount of your salary, you can use the PAYE/KiwiSaver deductions calculator.

Français

Français English

English

0 comments

{{like.username}}

Loading...

Load more