Offer for newcomers to Canada

- Up to 3 years with no monthly fees

- Enjoy $100 cashback when you open a chequing account¹

Receive $100 cashback directly in your new account thanks to the partnership between pvtistes.net and National Bank of Canada².

Fill out the secure form from your country in 5 minutes, up to 90 days before your arrival in Canada.

Within a few days, you will receive a confirmation email for your account opening.

Upon your arrival in Canada, book an in-person appointment to finalize your account opening.

Take advantage of this offer and get much more than just a bank account!

- Access an international wire transfer service⁴.

- Open an account from your country.

- Make a transfer before you leave.

- Access your funds as soon as you arrive.

- Save on your banking fees.

- Receive guidance before and after you arrive in Canada with our practical guide and from our advisors.

- Access a network of over 2,800 ATMs across the country.

Why choose National Bank of Canada?

-

Environement: We are working to develop a green economy

-

Social: We enrich communities

-

Governance: We govern according to the highest standards

Q&A

Details and conditions of the $100 cashback offer

During the promotion period, open a first chequing account as the main account holder using the redirection link on this page and sign up for the offer for newcomers.

Within 150 days of opening the chequing account and signing up for the eligible package/offer, complete the following 3 steps:

- Sign up for online banking

- Carry out 10 eligible transactions, including:

- Debit card purchases

- Bill payments using your online banking or the National Bank mobile app.

The following transactions are excluded:

Refund of purchases (Interac®)

Reimbursement of fees

Flat monthly fee

Account handling charges

- Maintain this package for newcomers for at least 120 days after opening the new chequing account.

You must not have a chequing account, CAD Progress Account, Crescendo Account®, The Strategist Account®, The Natcan Strategist Account, Special Project Savings Account, Superior Flex Line Program®, Home Improvement Line of Credit, Personal line of credit, All-In-One Line of Credit®, or must not have had a National Bank High Interest Savings Account, alone or jointly in the past 36 months.

Other conditions:

- You can receive only one cashback for this chequing account.

- You must be at least 18 years old when you open the new chequing account through our digital solutions.

- You need to keep the new chequing account for at least 12 months starting when the chequing account is opened. If you don’t meet this condition, you’ll have to reimburse a portion of the cashback for the product you didn’t maintain corresponding to the period still remaining.

- You must keep your National Bank chequing account in good standing until the cashback is deposited into the new chequing account. For the purpose of this promotion, a chequing account is not in good standing if:

- It is overdrawn, meaning it has an unauthorized negative balance.

- It has been used in an inappropriate, unauthorized, illegal or abusive manner, as described in section 8.7 of the National Bank Deposit Account Agreement.

- You must not be employed by National Bank, CWB® or one of its subsidiaries. Spouses of employees are also not eligible.

- This promotion may be modified or withdrawn without prior notice.

- This promotion cannot be combined with any other National Bank cashback promotion applicable to chequing accounts or banking packages. However, it can be combined with another eligible National Bank credit card, mortgage loan, mortgage insurance, or investment promotion.

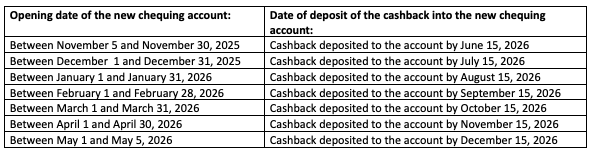

When will the cashback be paid to your chequing account?

How long does it take to receive a debit card?

The delivery time for a credit card is 5 to 7 business days if you apply online, and 7 to 10 business days if you fill out a paper form at one of our branches.

Details and conditions of the bank account

Minimum savings of $334.92 over 3 years

You can save at least $334.92 over 3 years if you meet all the following conditions:

- Visit a branch to open a bank account and

- sign up for the Newcomers to Canada package

$334.92 savings over 3 years:

- Year 1: No flat monthly fee (save $15.95/month for 12 months)

- Year 2: A flat monthly fee of $7.98 instead of $15.95 (save $7.97/month for 12 months)

- Year 3: A flat monthly fee of $11.96 instead of $15.95 (save $3.99/month for 12 months)

The monthly fee of $15.95 for your banking package will be charged as of the fourth year. To be eligible for this savings, you must maintain the account and package for at least 36 months. You will no longer qualify for the discount if you don’t keep these products.

Maximum savings of $671.30 over 3 years

You can save up to $671.30 over 3 years if you meet all the following conditions:

- Visit a branch to open a bank account

- Sign up for the Newcomers to Canada package

- During the first year after you sign up for the Newcomers to Canada package

- Apply for and activate a qualifying personal National Bank Mastercard® credit card3

- Sign up for eStatements

During the second and third years after you sign up for the Newcomers to Canada package:

- Set up direct deposit in your National Bank account and receive your salary in the account at least once a month or

- Make at least two electronic bill payments monthly from this account.

The $671.30 savings over 3 years means the following fees will not be charged:

- The flat monthly fee for the Newcomers to Canada package for 3 years ($15.95/month for 36 months)

- The fee for your first order of cheques ($67.10/order)

- Account statements by mail free of charge for the first year ($30)

- The monthly fee of $15.95 for your banking package will be charged as of the fourth year.

Decrease of the savings

- To benefit from the full savings amount, you must maintain all those products and services and carry out the qualifying transactions for at least 36 months, unless otherwise indicated. If you don’t meet the conditions of the offer, your savings will be lower. If you don’t make your first cheque order, your savings will be lower.

Furthermore, if during any given month, you maintain your account and package but you don’t maintain one of the other products and services or if you don’t carry out the required transactions (for example if you make one bill payment instead of two), the Bank will charge you the service fee for the month. The monthly fee will be $7.98/month the second year and $11.96/month the third year. You will still benefit from a discount of $7.97/month the second year and $3.99/month the third year.

Finally, if you no longer have the account or the package you will no longer be eligible for the savings

Is it possible to open a joint account and still receive the $100 CAD?

To take advantage of this deal, is it mandatory to use the pvtistes.net link?

Legal disclaimers

™ National Bank Assistance Network is a trademark of National Bank of Canada used under licence by authorized third parties.

® Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated. Authorized user: National Bank of Canada.

1. You can take advantage of the Offer for Newcomers if you immigrated to Canada within the past 5 years. For full offer terms and conditions, see the "Details and conditions of the offer" section. The Bank may modify, extend or withdraw the offer at any time without notice. The offer may not be combined or used with any other National Bank offer, promotion or benefit. Fees may apply for transactions not included in the Offer for Newcomers. For details of transaction fees, see the Fee Guide [PDF].

2. Certain conditions apply. Visit the Conditions of the $100 cashback offer for details.

3.

- Be a newcomer aged 18 or older

- Apply to open an account from your home country or within 5 years of arriving in Canada

- Be the sole user of the account

4. The Mastercard® and Interac® International Transfer service is available at a cost of $5.95 per transaction, regardless of the account you hold. The amount received by the recipient may differ from the amount sent, as intermediary or recipient banks may deduct their fees directly from the original transfer amount. This service allows you to send money to the United States, India, the Philippines, the United Kingdom, and the following 19 countries: Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia, and Spain.

5. The telephone assistance service offered by National Bank Assistance Network™ is available for 12 months from your account opening date. The content of the packages and terms described are subject to change.

6. Financing subject to credit approval by National Bank. Certain conditions apply. Eligible credit cards: mycredit®, MC1, Allure, Syncro, Platinum, Echo Cashback, World and World Elite.

7. A security deposit may be required under certain circumstances.

Français

Français English

English

213 Reviews

Please leave your feedback or ask questions

Hello,

I’ve been in Vancouver for a month and I opened a bank account with BNC using your “tip on pvtiste.net”. I followed the steps provided (account creation and 10 transactions), but I still haven’t received the 100 CAD. Is it possible to know why and how to fix this?

Thank you in advance for your reply,

Sincerely,

Paul Pillion

Hello Paul,

Here are the details regarding the CAD 100 deposit into your bank account:

Conditions for eligibility:

During the promotional period, open your first bank account for newcomers using the redirection link available on the pvtistes.net website as the primary account holder.

Within 150 days of opening your bank account, complete the following two steps:

1) Sign up for online banking

2) Make a total of 10 eligible transactions from among the following:

– Debit card purchases

– Bill payments using your online banking or the National Bank mobile app

The following transactions are excluded:

– Purchase refunds (Interac®)

– Fee reversals

– Fixed monthly fees

– Account maintenance fees

And the timeframes within which you will receive these funds:

November 5 to 30, 2025: Remittance deposited to the account by June 15, 2026

December 1 to 31, 2025: Remittance deposited to the account by July 15, 2026

January 1 to 31, 2026: Remittance deposited to the account by August 15, 2026

From February 1 to 28, 2026. Deposit to be made by September 15, 2026.

If you have any further questions, please feel free to send me a private message.

Have a good day,

Vanessa

Hello,

My boyfriend and I just arrived in Vancouver. We had appointments with two different advisors and received our debit cards, but not credit cards because we don’t have jobs yet, so we don’t have any income. They told us to come back to order them when we find a job.

Our advisors also said they weren’t aware of the $100 bonus offered for opening accounts, so we weren’t able to take advantage of it.

Where could we find help to get a credit card?

Thank you for your reply.

Hello Lucie,

Did you still apply for the credit card? Did you ask your advisors to apply for it?

Regarding the 100 CAD, you are entitled to it if you completed your online account pre-opening through pvtistes.net.

I also suggest you consult the tutorial on “how to obtain the 100 CAD” on the pvtistes website to ensure you meet all the necessary requirements.

If you need more information, you can contact me via private message.

Thank you

I asked her to order it, but she replied that since I don’t have a job right now, my application would probably be rejected and that it would be better to apply once I’ve found work… The same goes for my partner.

We both went through PVTistes for our pre-opening of our accounts. I sent you a login request so I can message you privately 🙂

Hello,

I opened my BNC account through the newcomer offer and via the PVTiste.net link in June 2025.

To date, I have not received the $100 welcome bonus.

To my knowledge, I followed the steps and the conditions for receiving the bonus have been met.

My BNC branch says they cannot help me and redirects me to the customer service number (printed on my debit card).

No one answers this number (I have tried four times, with a wait of 40 to 50 minutes each time).

I must admit I am quite lost and don’t know who to turn to.

Do you have a phone number or email address where someone could take my call/request?

Thank you in advance for your help,

Hi Ilias, thank you for your feedback! We’d be happy to look into this with you. You can call our customer service department at 1-888-835-6281 weekdays from 7 a.m. to 10 p.m. and weekends from 8 a.m. to 8 p.m. ET. We’re also available via Facebook Messenger. Thank you!

– Sue

Everything went very well with the Working Holiday Visa offer. I received excellent support, a warm welcome, and plenty of information – I’m delighted! 🙂

I recommend BNC because I had an appointment during the day to open an account and left with my debit card the same day. I received my credit card 1 week after my appointment which is still fast.

There are many BNC branches in all provinces which is not the case with some banks.

3 years of free banking fees which is also a plus.

Hello,

I’m very surprised to discover that the offer actually ends after two years. See the email I received this week:

The promotion applicable to the second year of your banking plan for newcomers will end on October 18, 2025.

After this date, your fixed monthly fees will be $11.96 for the next 12 months (a 25% discount).

Has the three-year fee-free offer expired, or what?

You might as well change banks with such monthly fees.

Hello Marie,

Thank you for your feedback regarding the banking offer for newcomers to the National Bank of Canada.

The “up to 3 years with no fixed monthly fees” offer is real, but it is conditional on certain actions and the retention of specific products for the entire duration of the offer. Here are the highlights:

1st year: No fixed monthly fees (savings of $15.95/month).

2nd year: Fees reduced to $7.98/month (instead of $15.95).

3rd year: Fees reduced to $11.96/month (instead of $15.95).

To benefit from these discounts, you must:

1- Open a bank account at one of our branches

2- Sign up for the Newcomer Offer

Before the end of the first year following your Newcomer Offer:

– Sign up for and activate an eligible National Bank Mastercard personal credit card.

– Sign up for electronic bank statements.

During the second and third years following your Newcomer Offer:

– Register your payroll deposit to the bank account you hold at one of our branches, and have your payroll deposited at least once a month; or

Pay at least two bills electronically per month from this bank account.

If these conditions are not met at any time, the monthly fees will be adjusted accordingly, as indicated in the email you received.

We invite you to review the full terms and conditions of the offer.

Please feel free to contact us if you have any questions or would like to review your situation.

I remain available via Private Message if you have any additional questions.

Vanessa Rodriguez

National Bank of Canada

Hello,

My partner and I arrived in Canada in March 2025. We each opened an account at NBC as part of the Working Holiday Visa offer. However, to date, we have still not received the $100 bonus provided for in this offer.

To the best of my knowledge, we followed all the required steps when opening an account at a branch. Could you please advise us on how to resolve this situation?

Thank you in advance for your assistance.

Thank you,

Hello Sébastien 🙂 We can verify the information in your file. You can write to us privately via Facebook Messenger, or call us at 1-888-835-6281. We look forward to hearing from you!

Me neither, they are mythos, pardon the expression, this bonus does not exist but they will do everything not to give it. I am in a similar situation.

Hello, @Mo, I just wrote to you in PM

Hi Sébastien, Vanessa sent you a PM. Don’t hesitate to contact her. If you did everything correctly, you’ll get the $100 🙂

Mo, be careful not to mix everything up. You didn’t benefit from our offer because you switched to another offer that isn’t related to us…

Hello,

I’ve been in Canada since the beginning of June. I opened my account in May 2025, and I still haven’t received the $100. However, I think I followed all the conditions mentioned in order to receive this bonus. I was wondering if this was normal?

Thank you for your reply 🙂

Hello Jeremy 🙂 It may take a few months, but we will be able to verify the information on your profile. You can write to us via Facebook Messenger privately, or call us at 1-888-835-6281. We look forward to hearing from you!

I opened my BNC account using the PVTiste link in May 2025. I was entitled to a $200 welcome offer under certain conditions. My advisor at the St Jacques Street branch in Montreal wanted to offer me an even better offer. I never received a welcome offer, the latter no longer responds, I tried to contact the branch numerous times via form, via my space and via email. It’s been 4 months since I received an answer to my questions. The branch is not responding. I find it shameful. Don’t go to this bank if you just want follow-up. Even France is better at this. That’s saying something.

Shame on PVTIs too for making such deceitful partnerships. Truly shameful.

Hello Mo! Thank you for taking the time to share your situation with us. The Working Holiday Visa offer includes a cash rebate of up to $100.

I’m truly sorry for the difficulty you had reaching your branch. If you’d like to follow up on an additional rebate promised when you opened your account, please feel free to write to us privately via Facebook Messenger. We’d be happy to look into it with you!

@NationalBankCanada -> The offer in March was $200, not $100. Another -little- lie from you.

Hello,

Thank you for taking the time to share your experience. We are sincerely sorry to hear that your account opening with the National Bank of Canada did not meet your expectations, and we fully understand your frustration.

Regarding the welcome offer related to the partnership with PVTistes, we would like to assure you that our intention remains to respect the announced conditions and to provide you with a service that meets your expectations. We regret that you were unable to receive a response from our Saint-Jacques Street branch, and we take your message very seriously.

We would like to inform you that the offer agreed upon with PVTistes has been maintained at CAD 100 for several years. To better understand your situation, could you please tell me the exact offer presented to you at the branch?

To review your file in more detail and provide you with a quick solution, please send your contact information (full name, date of birth, and account opening date) to the following address: [email protected].

Please rest assured that we will do everything possible to clarify the situation and provide you with personalized follow-up as quickly as possible.

We thank you for your patience and hope to regain your trust.

Have a nice day,

Vanessa

{{like.username}}

Loading...

Load more